Solution #8: Make Universities Use their Endowments to Guarantee Student Loans

There are few injustices greater than forcing taxpayers who did not attend a university to pick up the costs for higher education of those who did. That is exactly what happens when the federal government guarantees student loans and then forgives them. It is all the more absurd when one considers just how much capital these universities are sitting on.

It has been estimated that 132 universities in the US have endowments of over $1 billion. These universities, who educate a total of 4.2 million students, have a collective endowment of over $700 billion. Without boring you with the arithmetic, that is plenty of capital to backstop a loan guarantee program with up a 5% credit loss expectation.

Hundreds more universities have endowments between $500 million and $1 billion. These tend to be public universities with far lower tuitions, meaning the arithmetic will still work for them.

Of course, the universities don't want this. They want the government to guarantee the loans for three reasons:

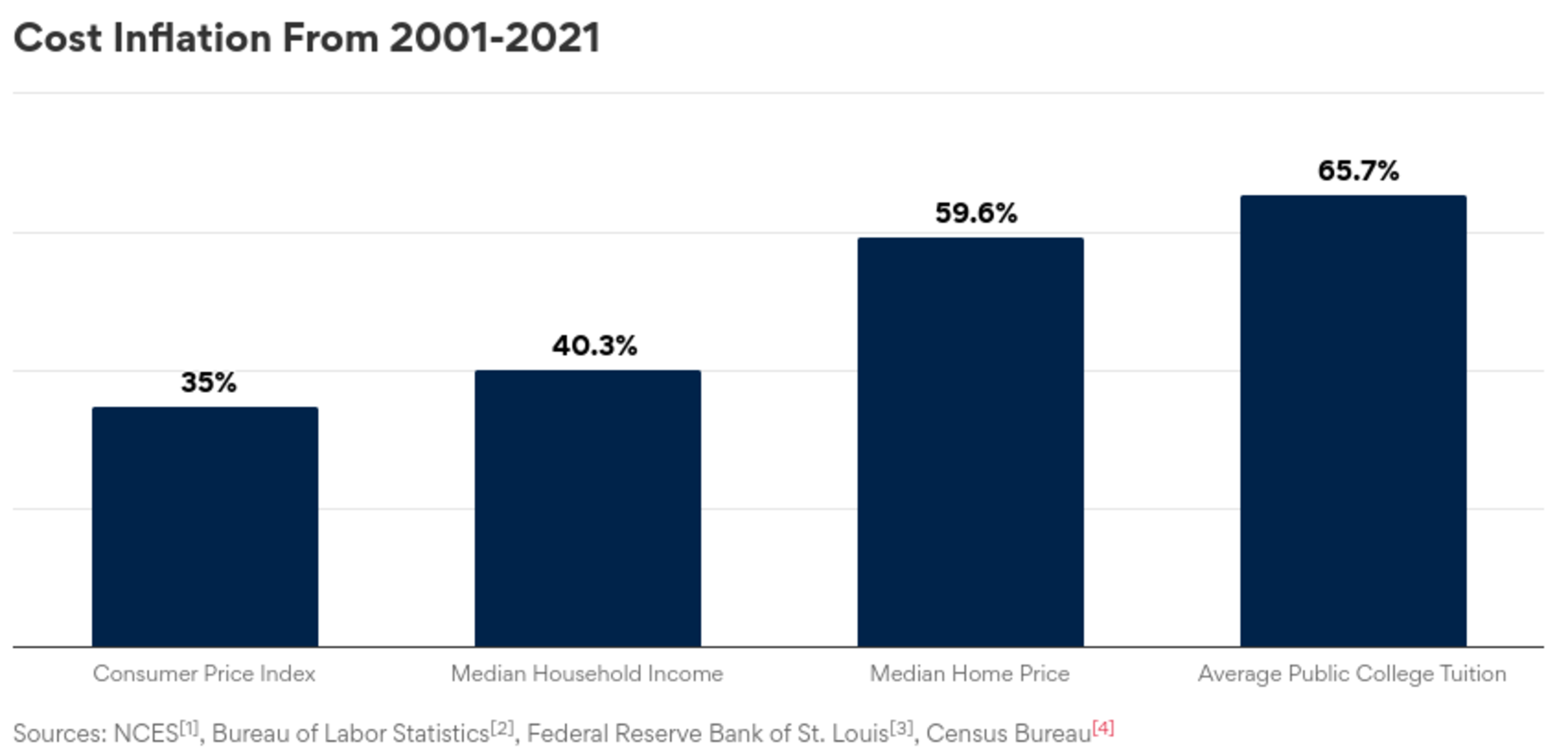

- It allows them to raise tuition at rates far above inflation. Tuition at public universities rose by almost 2x the general inflation rate from 2001-2021. And elite private institutions increased their tuitions at even higher rates.

- They can be indifferent as to whether or not their students' degrees are adequate to service the debts they have racked up over four or five years.

- They can use the endowment to instead fund administrators' priorities (which is usually the hiring of more administrators).

To ask taxpayers to pay off the debts of strangers, someone who chose to go to law school instead of learning how to weld, is wrong. And it's stupid to continue wasting taxpayer dollars on such a money-losing program.

Make the universities do it themselves.